Baridhi Malakar

I earned my PhD in Finance at the Scheller College of Business in the Georgia Institute of Technology. My research primarily focused on the relative value and pricing of municipal bonds due to credit risk events.

I currently work as a senior quantitative analyst in risk management at Western Alliance Bank in Phoenix, AZ. During my PhD, I ran three half marathons in Atlanta with a personal best of 2 hour, 15 mins.

Before joining the PhD program, I received a Bachelor's in Technology (civil engineering) from the Indian Institute of Technology Roorkee and pursued my MBA in Finance at XLRI Jamshedpur. Thereafter, I worked across investment banking and currency derivatives in Mumbai, India.

I also hold an MS in Economics and an MS in Management from the Georgia Institute of Technology.

You may reach me via email at baridhi.malakar@scheller.gatech.edu.

(The profile image was created using The Wall Street Journal AI Portrait.)

Research

My research focuses on asking questions that view local communities as potential stakeholders to firms. In my sole-authored paper, I examine how the fiduciary duty of municipal advisors affects municipal issuers' offering yields. A co-authored paper examines how do corporate subsidies affect local governments' borrowing costs in the United States? My third paper dmeonstrates the consequences of large firm bankruptcies on local communities and their municipal bonds. And finally, do managers really walk their talk on environmental and social topics?

Publications

1. Impact of Corporate Subsidies on Borrowing Costs of Local Governments: Evidence From Municipal Bonds

Published in the Review of Finance

-GSSI International Real Estate Review Best Paper Award, AREUEA 2021 (Shortlisted)

We analyze the impact of $38 billion of corporate subsidies given by U.S. local governments on their borrowing costs. We find that winning counties experience a 13.6 bps increase in bond yield spread as compared to the losing counties. The increase in yields is higher (16 - 21 bps) when the subsidy deal is associated with a lower jobs multiplier or when the winning county has a lower debt capacity. However, a high jobs multiplier does not seem to alleviate the debt capacity constraints of local governments. Our results highlight the potential costs of corporate subsidies for the local governments.

2. Fiduciary Duty in the Municipal Bonds Market

Published in the Municipal Finance Journal

-FMA Annual Meeting Special PhD Paper Presentations, 2022; FMA Annual Meeting Doctoral Student Consortium, 2022; University of San Francisco, 2022; Cornerstone Research, 2022; Southwestern Finance Association (SWFA), 2023; Clemson University, 2023

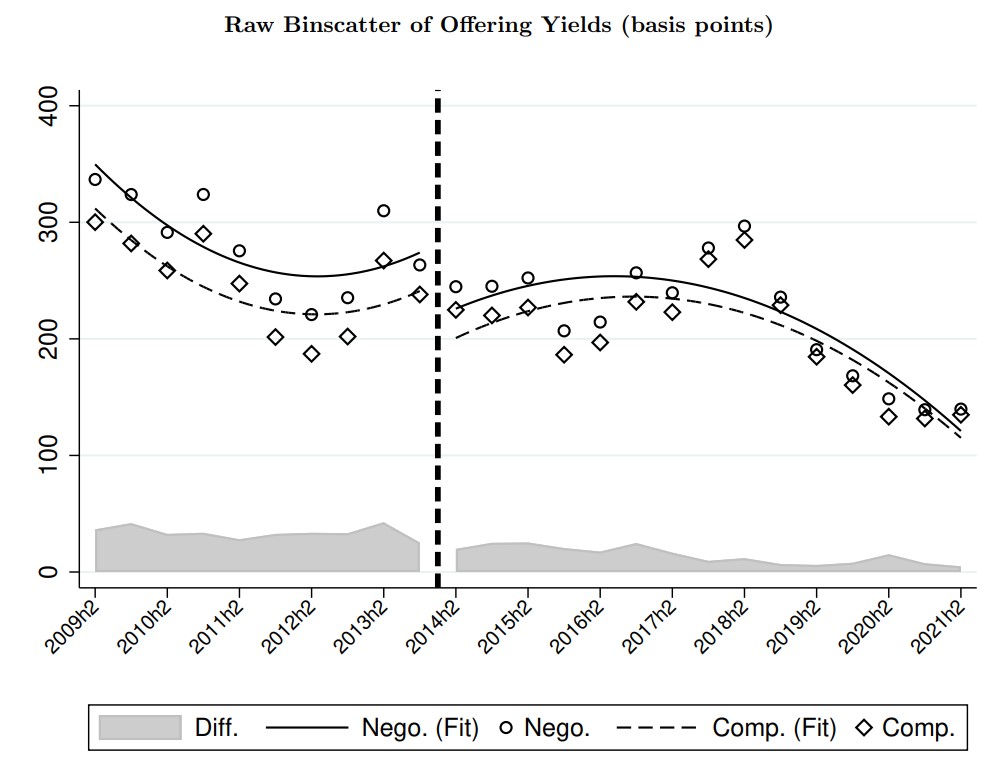

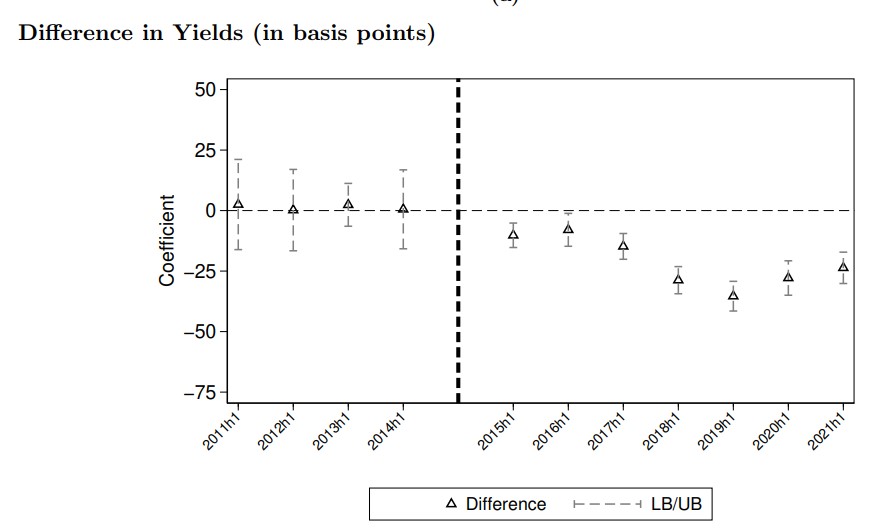

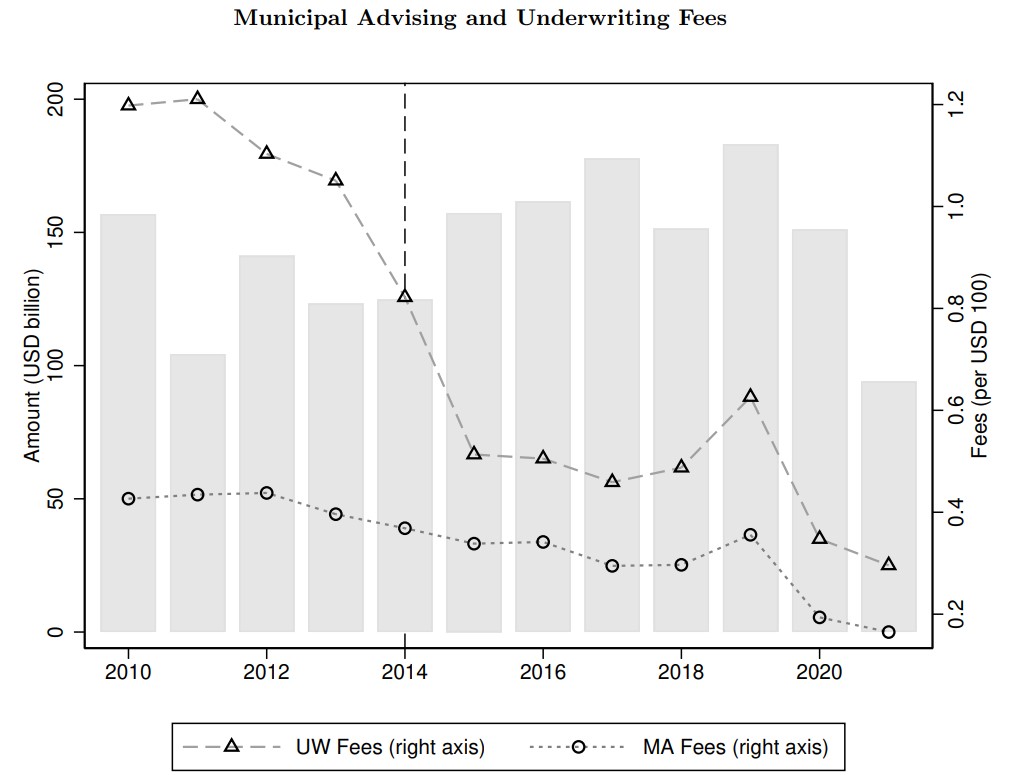

I examine whether the imposition of fiduciary duty on municipal advisors affects bond yields and advising fees. Using a difference-in-differences analysis, I show that bond yields reduce by 9\% after the imposition of the SEC Municipal Advisor Rule. Larger municipalities are more likely to recruit advisors after the rule is effective and experience a greater reduction in yields. However, smaller issuers do not seem to significantly benefit from the SEC Rule in terms of offering yield. Instead, their borrowing cost increases if their primary advisor exits the market. Using novel hand-collected data, I find that the average advising fees paid by issuers does not increase after the regulation. Offering yields reduce due to lower markup at the time of underwriting, driven by issuers for whom advisors play a more significant ex-ante role in selecting underwriters. Overall, my results suggest that while fiduciary duty may mitigate the principal-agent problem between some issuers and advisors, it has limited effect on small issuers.