Baridhi Malakar

I earned my PhD in Finance at the Scheller College of Business in the Georgia Institute of Technology. My research primarily focused on the relative value and pricing of municipal bonds due to credit risk events.

I currently work as a senior quantitative analyst in risk management at Western Alliance Bank in Phoenix, AZ. During my PhD, I ran three half marathons in Atlanta with a personal best of 2 hour, 15 mins.

Before joining the PhD program, I received a Bachelor's in Technology (civil engineering) from the Indian Institute of Technology Roorkee and pursued my MBA in Finance at XLRI Jamshedpur. Thereafter, I worked across investment banking and currency derivatives in Mumbai, India.

I also hold an MS in Economics and an MS in Management from the Georgia Institute of Technology.

You may reach me via email at baridhi.gatech@outlook.com.

(The profile image was created using The Wall Street Journal AI Portrait.)

Research

My research primarily focuses on event studies in the municipal bonds market. In my sole-authored paper, I examine how the fiduciary duty of municipal advisors affects municipal issuers' offering yields. A co-authored paper examines how do corporate subsidies affect local governments' borrowing costs in the United States? My third paper dmeonstrates the consequences of large firm bankruptcies on local communities and their municipal bonds. And finally, do managers really walk their talk on environmental and social topics?

Publications

1. Impact of Corporate Subsidies on Borrowing Costs of Local Governments: Evidence From Municipal Bonds

Published in the Review of Finance

- GSSI International Real Estate Review Best Paper Award, AREUEA 2021 (Shortlisted)

We analyze the impact of $38 billion of corporate subsidies given by U.S. local governments on their borrowing costs. We find that winning counties experience a 13.6 bps increase in bond yield spread as compared to the losing counties. The increase in yields is higher (16 - 21 bps) when the subsidy deal is associated with a lower jobs multiplier or when the winning county has a lower debt capacity. However, a high jobs multiplier does not seem to alleviate the debt capacity constraints of local governments. Our results highlight the potential costs of corporate subsidies for the local governments.

2. Fiduciary Duty in the Municipal Bonds Market

Published in the Municipal Finance Journal

- FMA Annual Meeting Special PhD Paper Presentations, 2022; FMA Annual Meeting Doctoral Student Consortium, 2022; University of San Francisco, 2022; Cornerstone Research, 2022; Southwestern Finance Association (SWFA), 2023; Clemson University, 2023

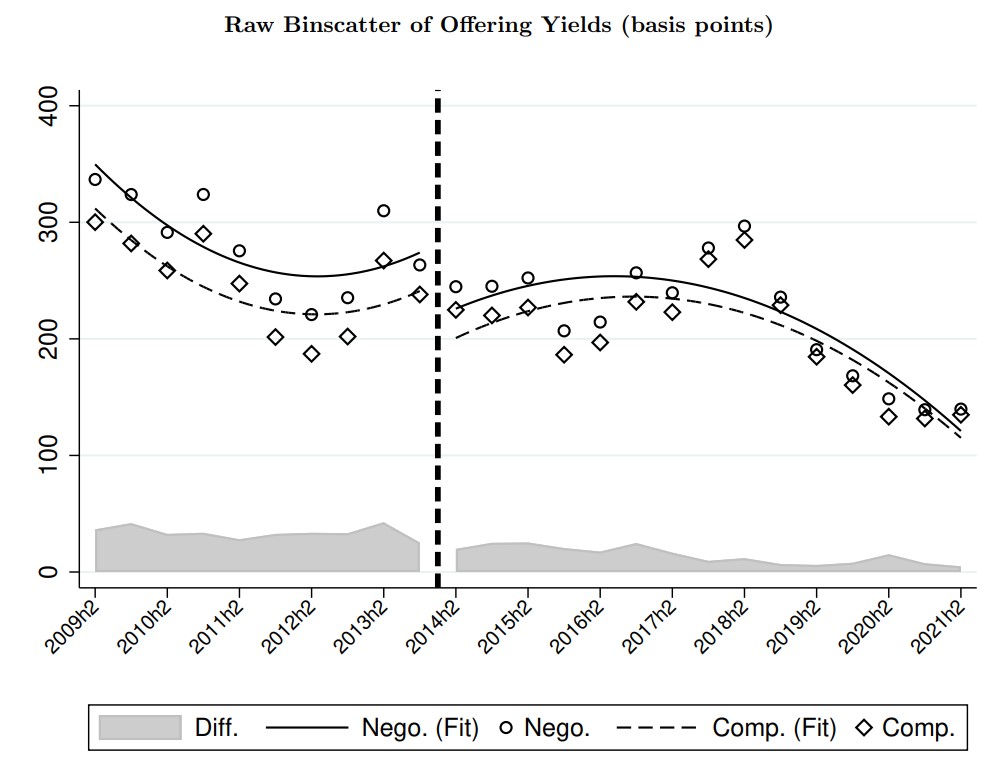

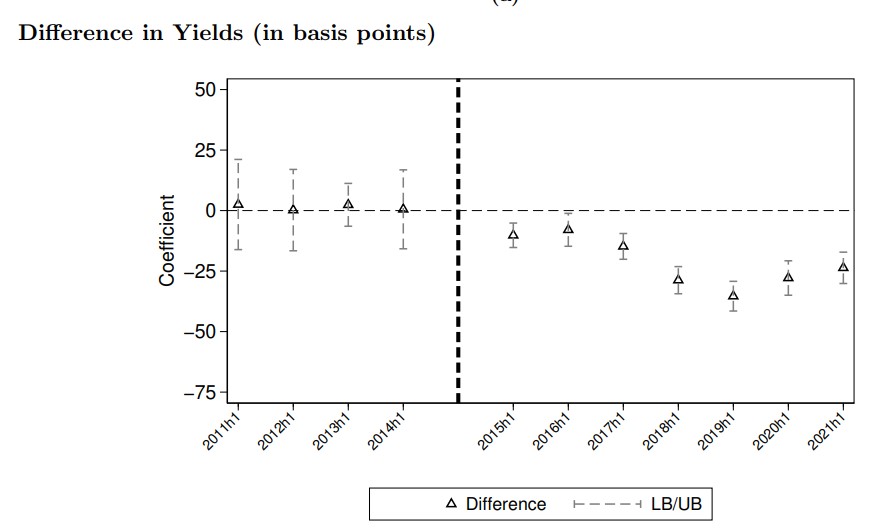

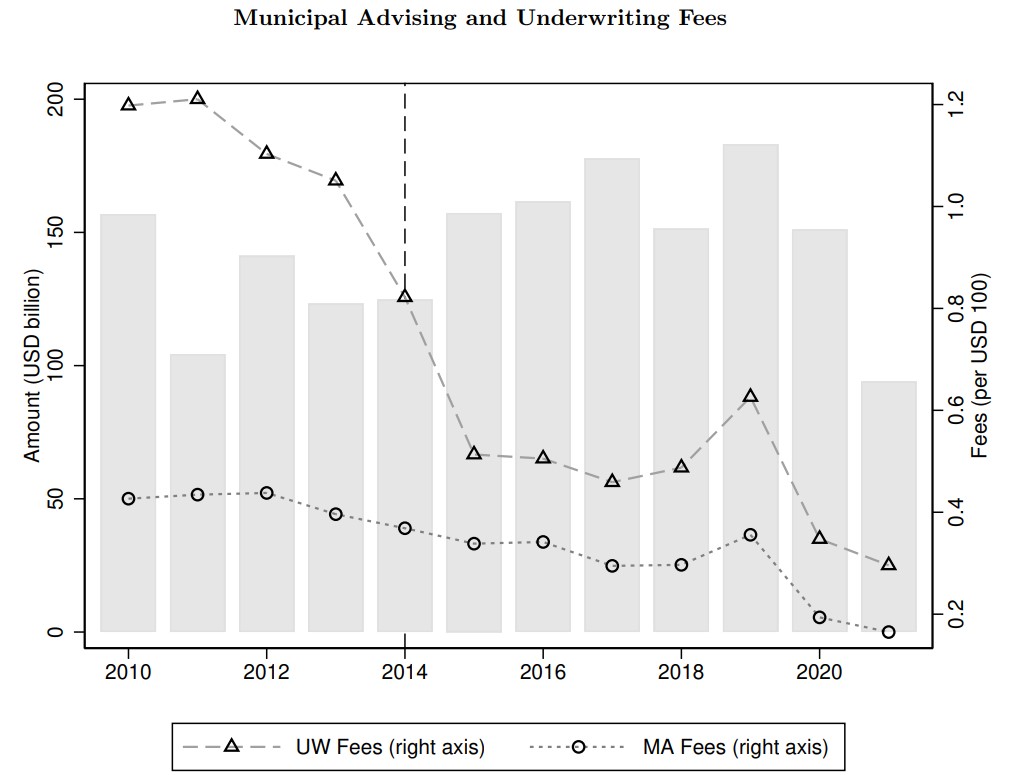

I examine whether the imposition of fiduciary duty on municipal advisors affects bond yields and advising fees. Using a difference-in-differences analysis, I show that bond yields reduce by 9% after the imposition of the SEC Municipal Advisor Rule. Larger municipalities are more likely to recruit advisors after the rule is effective and experience a greater reduction in yields. However, smaller issuers do not seem to significantly benefit from the SEC Rule in terms of offering yield. Instead, their borrowing cost increases if their primary advisor exits the market. Using novel hand-collected data, I find that the average advising fees paid by issuers does not increase after the regulation. Offering yields reduce due to lower markup at the time of underwriting, driven by issuers for whom advisors play a more significant ex-ante role in selecting underwriters. Overall, my results suggest that while fiduciary duty may mitigate the principal-agent problem between some issuers and advisors, it has limited effect on small issuers.

3. The Evolving Role of 21st Century Municipal Financial Advisors

Published in the Public Budgeting & Finance, Special Issue [Open Access]

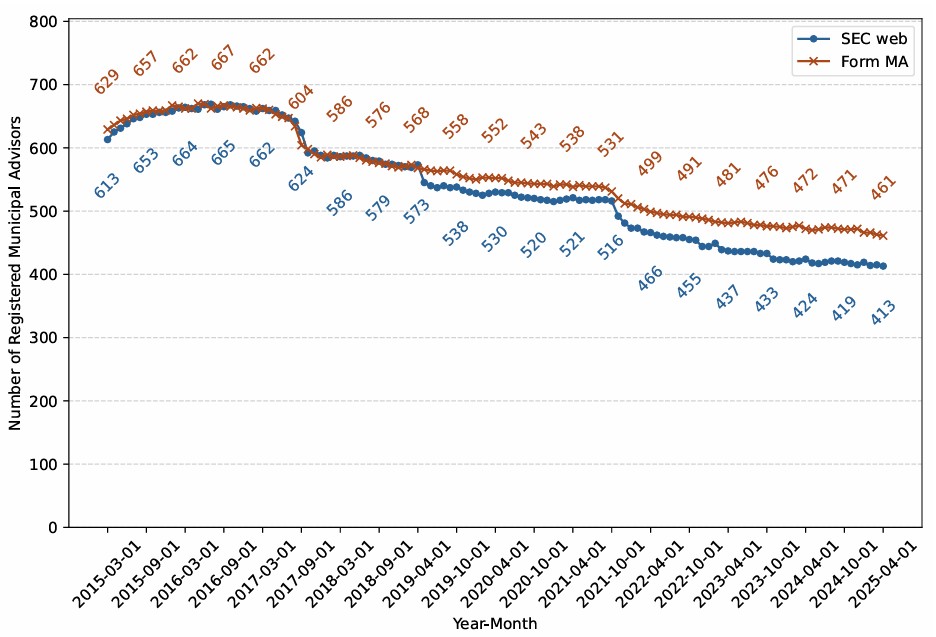

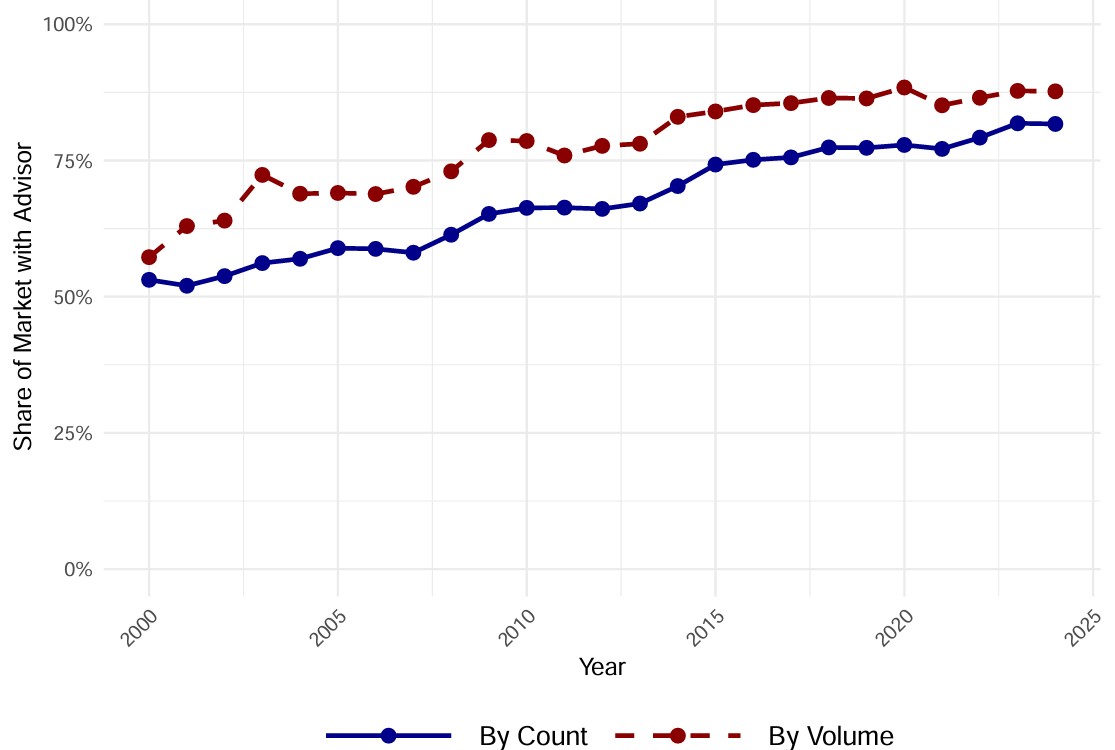

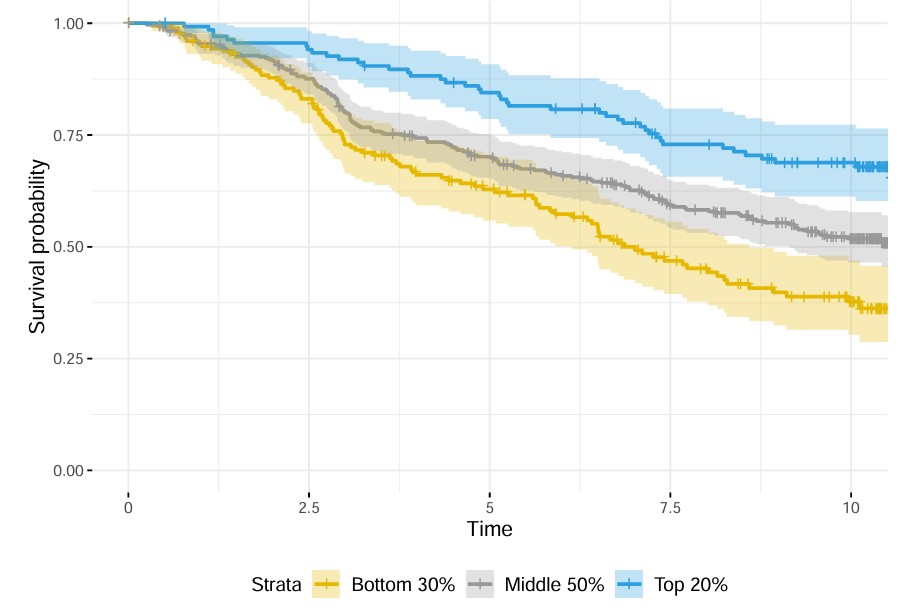

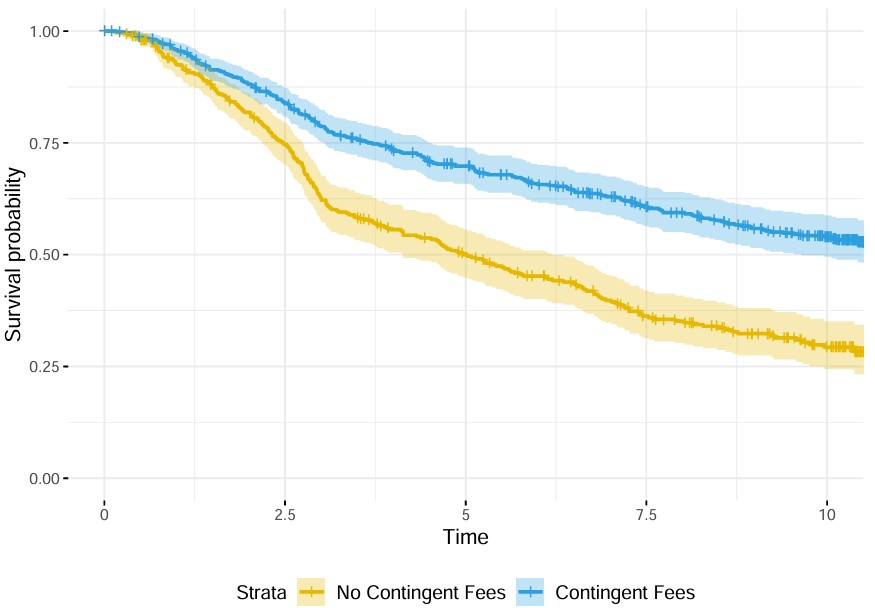

We describe the evolution of the market for municipal financial advice since the year 2000 and present new empirical facts. Using SEC municipal advisor filings, we show that the number of operating advisors has decreased over time. We document that withdrawals-either exits, reorganizations, or mergers-are concentrated among smaller firms and those charging noncontingent fees. Using bond issuance data, we document that the use of advisors is increasing broadly over time and that advisor relationships are sticky. We relate the presence of advisors to several phenomena: changing structural complexity, changing disclosure complexity, and the timing of redemption behavior.

Blogs

Rethinking Research: Private GPTs for Investment Analysis

-Published in the Enterprising Investor Blog

-CFA Institute Top 10 Blogs from Q3, 2025

This blog describes a customizable, open-source framework that analysts can adapt for secure, local deployment. It showcases a hands-on implementation of a privately hosted large language model (LLM) application, customized to assist with reviewing and querying investment research documents. The underlying Python code for this example is publicly housed in the Github repository here. Additional guidance is provided in this supporting document.

Working Papers

1. Communities as Stakeholders: Impact of Corporate Bankruptcies on Local Governments

-Featured by the CFA Institute Asia-Pacific Research Exchange, 2021

-Best Paper Award at the Annual Meeting of AEFIN Finance Forum, 2021

-AFA 2023, MFA 2022, AREUEA/ASSA Meeting, 2022, FMA 2021, UEA - North American Meeting, 2021, Virtual Municipal Finance Workshop at University of Notre Dame, 2020

We provide new evidence that the bankruptcy filing of a locally headquartered and publicly-listed manufacturing firm imposes externalities on the local governments. Compared to matched counties with similar economic trends, municipal bond yields for affected counties increase by 10 bps within a year of the firm’s bankruptcy filing. Our results highlight that local communities are a major stakeholder in public firms and how they are adversely affected by corporate financial distress.

2. Do Managers Walk the Talk on Environmental and Social Issues?

-Featured by the CFA Institute Asia-Pacific Research Exchange, 2021

-China International Conference in Finance 2022, OCC Symposium on Climate Risk in Banking & Finance 2022

We train a deep-learning based NLP model on various corporate sustainability frameworks in order to construct a comprehensive Environmental and Social (E&S) dictionary that incorporates materiality. We find that the discussion of environmental topics is associated with higher pollution abatement and more future green patents. Overall, our results provide some evidence that firms do walk their talk on E&S issues.

Resources

Data

Data on municipal advisor fees and underwriter fees collected through multiple FOIA requests in the US is housed here. For additional details, see my paper in the Municipal Finance Journal.

Data on Form MA submissions to the SEC used in ``The Evolving Role of 21st Century Municipal Financial Advisors'' is housed here. For additional details, see my co-authored paper in the Public Budgeting & Finance [Open Access].

Code

Code to build your own chatGPT-like bot is housed in this Github repository. Additional guidance included here and in a CFA Institute blog.

Code to download and clean Form MA data from the SEC used in ``The Evolving Role of 21st Century Municipal Financial Advisors'' is housed in this Github repository.

Awards

- Top 10 Blogs from Q3 by the CFA Institute, 2025

- Top 10 Downloaded Research Papers at Energy & Environmental Science eJournal by SSRN, 2024

- Letter of commendation from Jon Ossoff, United States Senator, for Ph.D. graduation, 2023

- Doctoral Student Travel Grant at the Southwestern Finance Association Annual Meeting, 2023

- Top 10 Downloaded Research Papers at Energy & Environmental Science eJournal by SSRN, 2023

- Top 10 Downloaded Papers at IO: Firm Structure, Purpose, Organization & Contracting eJournal by SSRN, 2022

- Best Paper Award at the Annual Meeting of AEFIN Finance Forum, 2021

- Global Social Science Institute (GSSI) International Real Estate Review Best Paper Award (Shortlisted) × 2, 2021

- Center for the Enhancement of Teaching and Learning’s Thank a Teacher Award, Georgia Tech., 2020

- Institute Silver Medal for highest overall GPA in the Department, IIT Roorkee, 2012

- Prabhakar Swarup Civil Engineering Award, Indian Institute of Technology Roorkee, 2012

- Madhusudan Dayal Mithal Medal for the highest GPA, Indian Institute of Technology Roorkee, 2012

- Rai Bahadur Sohan Lal Bhatia Mithal Medal for the highest GPA, Indian Institute of Technology Roorkee, 2012

- Rani Devi Bansal Medal for the highest GPA, Indian Institute of Technology Roorkee, 2012

- Shri Shiv Nandan Swaroop and Avadh Narayan Bhatnagar Prize for the Batch Topper, IIT Roorkee, 2012

- Dr. H.P. Sinha Merit Scholarship, Indian Institute of Technology Roorkee, 2011

- Gouri Shankar-Malti Prize for the highest GPA in III year, Indian Institute of Technology Roorkee, 2011

- Tara Chand Kanti Devi Prize for the highest GPA in III year, Indian Institute of Technology Roorkee, 2011

Invited Talks

- PanIIT USA Phoenix Chapter, Toast and Talks: Fixed Income ETFs, 2023

- Seminar presentation on sole-authored paper at Clemson University, 2023

- Seminar presentation on co-authored paper at Université Catholique de (UC) Louvain, Belgium, 2023

- Seminar presentation on sole-authored paper at University of San Francisco, 2022

- Seminar presentation on sole-authored paper at Cornerstone Research, 2022

Discussions

- Invited as Discussant at the Southwestern Finance Association (SWFA) Annual Meeting, 2023

- Invited as Discussant at the Atlanta Rising Scholar Symposium, 2022

- Invited as Discussant at the FMA Annual Meeting - Denver, 2021

- Invited as Discussant at the Atlanta Area Finance Ph.D. Brown Bag, 2021

- Invited as Discussant at the Urban Economics Association - North American Meeting, 2021

- Invited as Discussant at the AEFIN Annual Meeting - Finance Forum, 2021

- Invited as Discussant at the China International Risk Forum, 2021

- Invited as Discussant at the Urban Economics Association - European Meeting, 2021

- Invited as Discussant at the Financial Management Association (FMA) Annual Meeting, San Diego, 2018

Presentations

- Southwestern Finance Association (SWFA) Annual Meeting - Houston (TX), 2023

- American Finance Association (AFA) Annual Meeting - New Orleans (LA), 2023

- Corporate Restructuring & Insolvency Seminar, Harvard Law School, 2023

- FMA Annual Meeting Special PhD Paper Presentations - Atlanta (GA), 2022

- FMA Annual Meeting Doctoral Student Consortium - Atlanta (GA), 2022

- AREUEA/ASSA Meeting, 2022 × 2

- Midwest Finance Association (MFA) Annual Meeting - Chicago, 2022

- Wolfe QES NLP Conference, 2022

- Atlanta Rising Scholar Symposium, 2022

- Eastern Finance Association, 2022

- China International Conference in Finance, 2022

- OCC Symposium on Climate Risk in Banking and Finance, 2022

- University of Florida Research Conference on Machine Learning in Finance, 2022

- New Zealand Finance Meeting (NZFM), Auckland University of Technology, 2021 × 2

- National Tax Association (NTA) Annual Conference, 2021

- Conference on Financial Economics and Accounting (CFEA), 2021

- Urban Economics Association - North American Meeting, 2021 × 2

- Australasian Finance & Banking Conference, 2021 × 2

- India Finance Conference, 2021 × 2

- Conference on Asia-Pacific Financial Markets (CAFM), 2021

- National Tax Association (NTA) Graduate Poster Session, 2021

- FMA Annual Meeting - Denver, 2021

- School of City and Regional Planning (Georgia Tech.) seminar, 2021

- Annual Conference of the Italian Society of Public Economics (SIEP), 2021 × 2

- AREUEA International Conference - Singapore, 2021 × 2

- Annual Conference of the International Network for Economic Research (INFER), 2021

- Annual Meeting of AEFIN Finance Forum, 2021

- AEFIN Ph.D. Mentoring Day - Finance Forum, 2021

- Atlanta Area Finance Ph.D. Brown Bag, 2021

- AREUEA-ASSA National Meeting, 2021

- Urban Economics Association - European Meeting, 2021

- Florida International University seminar, 2021

- Tsinghua University Accounting Seminar, 2021

- Journal Of Investment Management (JOIM) Conference, 2021

- Conference on CSR, the Economy and Financial Markets, 2021

- CEF Group Climate Finance Symposium, 2021

- Wells Fargo Machine Learning Interest Group, 2021

- Virtual Municipal Finance Workshop at University of Notre Dame, 2020

- Trans Atlantic Doctoral Conference (TADC) LBS, 2020†

- FMA Napa Valley Conference, 2020†

- Brookings Institute Annual Municipal Finance Conference, 2020

- SFS Cavalcade North America, 2020

- European Finance Association (EFA) Annual Meeting, 2020

- Journal Of Investment Management (JOIM) Conference, 2020